Budget 2025/26

- Overview

- Our current financial position

- What a balanced budget is

- Our medium term financial strategy

- Reserves

- Council budgets - what we spend money on

We continue to operate in the context of financial and economic uncertainty which has seen disproportionate cuts to funding, delays to funding reform and increasing demand particularly in social care.

Our budget for 2025/26 is focused on delivering our Corporate Plan pledges to help Gateshead thrive. After listening to the views of residents throughout our consultation new homes, jobs, green spaces and further investment in the local environment are at the heart of our budget for 2025/26.

Our current financial position

Like all councils, we've faced increasing pressure on much needed services and limited budgets for many years. We have a proposed gross expenditure budget of £574.6m to deliver everything we possibly can for Gateshead and our residents. Our proposed income budget totals £245.9m and our proposed remaining net budget, of £328.7m, is funded through Council Tax, business rates, government grants and reserves.

Our Medium Term Financial Strategy (MTFS) estimates show that we will be required in future to make very difficult decisions and possibly implement new ways of working or re look at our service delivery model in order to achieve a balanced budget at the end of the MTFS period.

Did you know that

- 90% of properties in Gateshead are in Council Tax bands A to C

- it costs just under £900,000 per day to run our services

- 23% of our income comes from Council Tax

What a balanced budget is

Every council must have a balanced budget which means expenditure cannot be more than the council's income for the forthcoming financial year.

Our Medium Term Financial Strategy

The Medium Term Financial Strategy (MTFS) estimates the additional costs and pressures that the council is facing due to inflation, demand, and policy changes. The difference between estimated income and estimated expenditure leads to the " funding gap".

Like many households and businesses we also face increased costs for things such as energy and rising salaries for our own staff and for those who deliver services on our behalf such as care workers.

Reserves

Reserves (like savings) are held by us for many important reasons. Some of these are ringfenced for a specific reason, and cannot be used to support the general budget. They can also only be used once so are not a sustainable way to fund services.

In March 2024 we held £16.2m in our general fund reserve for unforeseen expenditure - we must keep 3% of our net budget as a minimum level.

In addition, we held £69.4m earmarked reserves - set aside for specific purposes. The proposed 2025/26 budget will use of £8.5m of earmarked reserves, and the MTFS outlines plans to use a further £4m of reserves by 2026/27.

Council budgets - what we spend money on

Our revenue and capital budget reports are agreed at Council in February each year. This sets out the Council Tax levels and the capital programme of activity for the coming year. By law, we must set a balanced budget by 11 March.

Revenue budget

The revenue budget is the term used to describe the amount that a local council spends on its day-to-day running of services. This includes wages and salaries, property and transport, running costs, repairs and maintenance, utilities and payments to suppliers. It is the same as day to day bills and costs that need to be paid to manage a household.

Gross budget is the total budgeted cost before any budgeted income is considered. The total gross revenue budget for running Council Services to be set in February 2024 is £574.6 million.

The net budget is the budgeted cost of the service after all the service specific income has been taken off such as trading income, service level agreements, fees and charges and service specific grants. The total net revenue budget for 2025/26 to be in February is £328.7 million. This is what is costs to run Council services and must be funded through government grant, council tax and business rate income.

How our revenue budget is funded

Capital spend

Capital spending is money spent on creating or improving assets where the benefits last more than 12 months. This often includes spending on things such as land and buildings or vehicles and equipment, which can be used over a long period. For example, if you purchase a house, this is your capital expenditure. This kind of spend is different to revenue spend, which covers day-to-day items to run services such as staffing and purchase of services, so it is budgeted for separately. Your daily outgoings such a purchasing food is the equivalent of revenue expenditure whereas an extension to a property for example is the equivalent of capital expenditure.

The capital programme is reviewed and approved annually by Council. The planned investment agreed in February 2024 for the capital programme totalled £506.4 million.

Priority is given to schemes which support the achievement of the council priorities, generate revenue savings or economic growth, maintain council assets or are a statutory requirement.

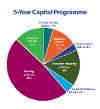

Capital Programme spend by strategy

How our Capital expenditure is funded

- Prudential borrowing - This is the main source of available funding and allows the Council to borrow from the Public Works Loans Board (PWLB) or market loans to fund the capital programme. Borrowing must be affordable so we have to be sure that we can pay back any borrowing including the principal and interest.

- Government grants - Grants can be made available to fund certain capital expenditure usually transport or school related. In most cases grant will part fund the project but will not provide ongoing revenue support.

- Capital receipts - These are the proceeds from the sale of council land, buildings and council houses greater than £10,000.

- External funding - Grants and other contributions may be awarded as part of annual settlements to support general capital expenditure, following applications for external funding to support specific schemes or through private sector contributions.

- Major Repairs Reserve (MRR) - This funds capital expenditure within the Housing Revenue Account and is ring-fenced for capital purposes.

- In 2025, the fund plans to collect £124m of council tax and around £86m of business rates

- In 2025/26 we will spend £80.0m of funding on schools.

- £89.6m on Housing Revenue Account (HRA)

- Capital - proposed budget is £625.3m

- Climate change - £28.1m - 4%

- Corporate Assets - £70.5m - 11%

- Digital Systems - £18.1m - 3%

- Economic Prosperity - £102.0m - 16%

- Health and Wellbeing - £24.4m - 4%

- Housing - £301.0m - 48%

- Transport - £81.2m - 14%