Housing Revenue Account (HRA) Business Plan 2024-2054

HRA Financial Plan

5.1 The Financial Plan shows how both the Council Housing Investment Programme and the day-to-day council housing services will be funded.

5.2 Overall, the revised HRA plan is fully costed and does not breach a minimum £3 million balance during the life of the plan (30 years). However, to incorporate the cost pressures and anticipated capital investment, including new social housing stock, borrowing will need to rise significantly above the current levels.

5.3 A copy of the HRA Operating Account 2024/25 to 2053/54 is attached at Appendix 1.

5.4 The plan requires as a minimum savings of £3.823million which has been phased as follows:

Year | Total annual savings (£) | Total cumulative savings (£) |

2025/26 | £1,604 |

|

2026/27 | £924 | £2,528 |

2027/28 | £633 | £3,161 |

2028/29 | £662 | £3,823 |

Total | £3,823 |

|

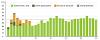

5.5 The capital investment included in the 30-year plan is £1.448 billion, the split of which is detailed in the following graph:

5.6 A summary of the planned five-year 2024/25-2028/29 capital programme is shown in Appendix 2.

5.7 Borrowing requirement

5.7.1 The proposed plan shows that by year 30 borrowing will increase to £1.006 billion which is £660.037 million higher than the current underlying loan debt. Additional borrowing will be required in 2025/26.

5.7.2 Whilst the borrowing is affordable within the context of maintaining a balanced HRA with a minimum reserve balance debt needs to be managed in the overall context of affordability for the council. The risks associated with borrowing including the interest cover will therefore need to be kept under review.

5.8 HRA reserve balances

5.8.1 The HRA can budget for a deficit in a particular year, but the HRA total reserve balance must not be negative. The business plan is set to assume that if the assumptions resulted in the reserve balance falling below the minimum required of £3 million in any year, then borrowing will be required. Borrowing can only be for capital purposes. Where revenue reserves are exhausted due to revenue expenditure exceeding income, then mitigating action is required.

5.8.2 The plan shows that over 30 years, the surplus carried forwards stays above the minimum balance.

5.8.3 The plan also shows that there are years where reserves will be used to fund predicted peaks in the capital programme due to lifecycle replacements. This minimises borrowing and reduces the level of interest charges that would be incurred.

5.9 Key assumptions

5.9.1 The financial plan is based on several key assumptions to mitigate against risks or changes that may occur over the life of the Business Plan.

5.9.2 The assumptions used for the next 5 years over the medium-term period 2025/26 - 2029/30 are outlined in the table below. As the HRA plan is over 30 years, future assumptions have been made in respect of the key items listed.

Assumptions | 2025/26 | 2026/27 | 2027/28 | 2028/29 | 2029/30 |

CPI | 1.65% | 1.63% | 1.64% | 2% | 2% |

RPI | 2.65% | 2.63% | 2.64% | 3% | 3% |

Rent increase | 3% | 2% | 2% | 2% | 2% |

Service charges | 3% | 2% | 2% | 2% | 2% |

Energy increase - included in management non-staff costs | 3% | 3% | 3% | 3% | 3% |

Pay inflation | 2% | 2% | 2% | 2% | 2% |

Repairs and maintenance - non staff costs | 3% | 3% | 3% | 3% | 3% |

Supervision and management non-staff costs | 3% | 3% | 3% | 3% | 3% |

Capital works costs - except certain fixed elements | 3% | 3% | 3% | 3% | 3% |

Void rates | 2.5% | 2% | 1.5% | 1.5% | 1.5% |

Bad debt rates | 0.95% | 0.95% | 0.95% | 0.95% | 0.95% |

Interest rates on borrowing | 4.3% | 4% | 4% | 4% | 4% |

Additional borrowing required | £4.520m | £27.860m | £19.582m | £16.548m | £10.333m |

Opening stock numbers | 17,889 | 17,787 | 17,613 | 17,492 | 17,432 |

Right to Buy sales | 115 | 115 | 115 | 115 | 115 |

Number of development units | 56 | 71 | 55 | 50 | 40 |

| Area of Business Plan | Comments | Assumptions | Risk | |

| Stock numbers | The number of dwellings drives the level of income and costs which vary with the number of properties. This includes right to buy numbers, demolitions, remodelling of stock and new developments. | Proposed numbers are as outlined in table 1 above. | There is a risk that the number of successful right to buy applications increase and or there are barriers to new development resulting in a variation to the stock base. Any variation will impact both income and costs. | |

| Inflation CPI/RPI | CPI annual inflation for July 2024 2.2% (up from 2% in June) and RPI of 3.6% up from 2.9% in June. OBR forecasts for future years predict CPI at 1.65% (Q3 2024) for 2024/25 1.63% 2025/26 and 1.64% 2026/27 and average 2% over future years. RPI assumed to be 1% higher than CPI | CPI and RPI rates have been taken for each year as shown in table 1 above. | OBR are the best estimates to hand however this will be kept under review. CPI impacts on both costs and income. | |

| Minimum working balance | The HRA has an agreed minimum balance requirement to ensure there is adequate reserves cover. | £3m assumed throughout the plan | There is a risk that this is insufficient and there are unforeseen events that cannot be met. | |

Salary increases (pay award) | This cost pressure relates to the cost of pay award agreed for employees of the council as well as agreed pay increments. Local Authority pay awards are determined through the national bargaining process rather than being mandated by government. However, the messaging and government resource allocations for the future are likely to influence that national bargaining process. | CPI used for the duration of the plan. | Pay increases which are agreed could be much higher than expected. This is unknown given pay uplift for 2024/25 is not yet agreed and is held in contingency.

| |

Revenue repairs | 2023/24 overspend on repairs of £6.3m of which £4.5m was accounted for in setting the 2024/25 budget and is reflected in the business plan. This is reflective of the additional demand on the service.

| Inflation assumption using RPI. | There is a risk that the void work cost and turnover rate does not enable delivery within budget. There is also a balance between void loss and cost of repairs and timing of major estate works. | |

Rent increases | Rent policy is CPI + 1%. | CPI is forecast to be 1.65% and therefore CPI+1% is assumed in the business plan reverting to CPI only thereafter. | There is a risk of government intervention and a cap on rent increases lower than presumed in the plan but as the forecast CPI is below the government target of 2% this is highly unlikely. A 1% variation on the rental increase would result in £3.7m less income over the medium term and £32.6m over 30 years and the plan would not be financially viable beyond year 28. | |

Service charge increases | Charges are based on full cost recovery however impact assessments are completed, and stepped charges applied where appropriate. Service charge increase should be broadly comparable to rent increases although this does not preclude full cost recovery. | For the purposes of financial modelling charges have been increased by CPI + 1% for 2024/25, however it has been assumed most costs increase with RPI. | Assumed that service charges align to rents, but this creates a small disparity between cost inflation and service charge inflation. | |

Void rates | Void rates vary depending upon the stock and within the plan for modelling purposes the stock has been divided to enable different void rates to be applied. This is most important for those subject to demolition or remodelling where void rates will increase as they are decanted. | Void rates used in the plan are outlined in table 1 above. The current void loss (to week 18) is 3.39% against a budget of 3% | There is a risk that void rates increase in areas where properties are more difficult to let or are unachievable and this will impact the level of income. | |

Bad debt rate | This is the value of the increase required to maintain the bad debt provision at an adequate level. Increasing current debt will have little impact as the debt profiling increases the risk of it becoming uncollectable with age. | Bad debt rates used in the plan are outlined in table 1 above. The 2023/24 actual was 1.2% - whilst this is higher than planned it is linked to the lower rent due to void loss and level of 2023/24 debt write off

| Income collection rates decrease but there is a lag in the impact on the provision due to the methodology used in maintaining the provision. | |

Other income | Non dwelling rents such as garages have experienced a reduction in demand and for the purposes of financial modelling have been maintained at the current budget for the life of the plan. The stock loss over the plan does not directly vary other income so this has been managed through inflation

| Non dwelling rent not inflated and Water Commission RPI to 2027/28 but no further inflation applied due to reduction in stock so assumed a level of offset. | Positive risk that non-dwelling rents can be increased without impacting demand. | |

Capital receipts | The income from right to buy receipts can be used to fund redevelopment. There is an accumulated reserve of £18.4m which is estimated to be used over the next 5 years. Receipts received in year will be used to fund the capital programme.

In 2022/23 the then government introduced for a period of two years the ability to retain the Treasury share. The RTB inputs in the plan now result in the generation of 1-4-1 receipts. Both types of receipts have specific constraints to their use around new properties and this is included in the development assumptions.

| Current average RTB value £96,917 (2023/24). Projected to increase with CPI.

Beyond year 8 there is no further development planned despite 1-4-1 receipts being generated.

If the receipts are not used, they must be repaid with interest and therefore an adjustment has been made in the plan to ensure the plan does not need to fund the interest but there would be a need to plan to use the receipts. | The sales are higher or lower than modelled which could impact the amount available to fund the capital programme. The government change the parameters in the right to buy calculation impacting the level of receipts. | |

Homes England grant funding | It is assumed new developments will attract funding The council has a good track recorded of securing Homes England Funding. | £50,000 per property assumed after using the Treasury retained RTB receipts as you cannot combine the use of them. | There's is a risk that Homes England Affordable Homes funding will be limited up to the end of the current bidding cycle (2026) which may limit access to grant availability. There may also need to be a conscious decision to not bid for grant and utilise the receipts.

| |

Major works | The HRA capital programme is reflective of the agreed 2024/25 programme with slippage from 2023/24 incorporated. Stock condition information has been updated and reflect the most up to date forecasts. | Based on stock condition survey and rise with RPI except for extensive exceptional works such as net zero carbon, aids and adaptations and estate works (non-dwelling works) which are cash limited. Most works vary with the stock numbers which is built into the business plan. | There is a risk that costs increase at a level above the forecast RPI.

There are further risks associated with governments relaunching of 'Decent Homes'. | |

Depreciation | Depreciation is a real cost in the HRA and is used to fund major repairs (capital). In 2023/24 the level of depreciation was £0.518m higher than originally budgeted. The revised plan is set at the same level as budget as there was no reported change to this in Q1. | Previous advice sought from JLL (council valuers). restricted to not increase with inflation. | There is a risk of change in market prices which impact the valuation, but the plan uses external advice and forecasting and will be reviewed annually. | |

Interest rates on borrowing | Borrowing rates are currently unpredictable. The rates for borrowing take account the term of the borrowing and therefore rates can vary. The plan assumes replacement of maturities as they arise and a provision to reduce the under borrowing. | Interest rates for new borrowing for 2024/25 are estimated at 4.3% with future years outlined in table 1 above. | There is a risk interest rates increase further however there could be a positive risk of rates reducing for new borrowing. | |

HRA debt | The opening HRA CFR is £345.505m. Each HRA loan is separately identified, and debt profiled based on known interest rates. It is assumed that when debt matures it is refinanced. | The level of additional debt over the 30-year plan is significant at £660.037m which is 79% loan to value against the current value of the stock. The business plan inflates the value of assets and therefore the target of 70% loan to value is not breached. Inflating the asset base is inconsistent with the deprecation assumption. Therefore, this level of debt whilst seemingly affordable is a significant risk to real terms affordability. |

| |